Money. The #1 reason people get divorced. The #1 big ol mess in politics. The #1 thing that impacts your quality of life.

*I’m not a financial advisor. Robo-advisors are cool. Check one out.

I know a lot of my readers are undergrad students. Some readers have jobs. Some have student loans. Some have credit card debt.

We are all different. But that’s good. No one way to make money, save money or grow money.

Here’s what I’ll touch on today:

where to start: self audit

save and invest? now?

housing- we all need one- how to make it work for you ** stay tuned, this one deserves its own post!

1. Self audit.

What do I mean? Make a google sheet or excel sheet with your debits (money going out) and credits (money coming in).

That’s it.

This is enlightening because the more you are aware of your debits and credits, the quicker you make changes and start working towards your goals.

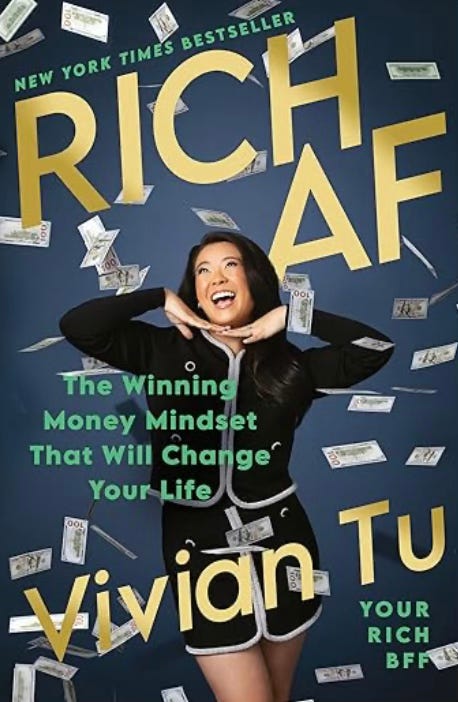

I LOVE this book. It’s easy to read. And you get access to her website and online workbooks.

If I had to give you one financial goal before 2024 ends, it would be to buy and read this book.

Essentially, she will give you the tools to zoom out and get an idea of where you stand, and then what your priorities should be.

TLDR:

Get your mind straight about money. There’s a lot of it out there. Don’t penalize yourself for buying a coffee. Instead, go make money, learn a skill, make a plan to pay off debt.

She has an interesting way of paying off debt (mainly credit card debt). She recommends taking out a personal loan (**with a lower interest rate than the credit cards were charging you), and then paying that off. Here is her favorite personal loan to do this with. You have to apply to see your rate, but it is likely closer to 10-12% than 29% (like most credit cards).

Go watch her insta. You’ll learn a ton.

2. Save and Invest? At my (young-ish) age??

yep.

Even if you are paying for school, even if you are working only 4 hours a week, even if you have loans waiting/looming on the other side.

If you save now, it will start to grow.

Big points:

Your money is losing value in your checking account. Sign up for a free High Yield Savings Account. Try to put some money in every month, and it will retain its value/ fight inflation.

Here’s one with Forbright, with a current rate of 5.0% APY. I love Forbright! They have brick and mortar stores and they have HUMANS answering their calls!

Here’s one through SoFi. Current rate of 4.3%. I like that you can fill “buckets” or goals, for example “Cabo SB 2025” or “Vet School Tuition”.

Invest: SoFi makes it easy to buy into the stock market through your SoFi account. You can easily transfer money and buy an ETF. Easy to google “good ETF to invest in.”

My Tip: Don’t over-research. Just pick a High Yield Savings Act, pick an ETF, put it on autodeposit once a month. Be done. Check.

To Do List:

Invest in yourself. School never taught you this stuff. Teach yourself, and start now. My advice: find someone smarter and steal their homework, steal their hard earned knowledge. Best book (IMHO): Rich AF, by Vivian Tu.

Get a Savings Account that works for you.

Live beneath your means. Only charge to your credit card what you can pay for TODAY. Pay your credit card off every month. In full. You know how you work to copy/paste those coupon codes and take advantage of sales??!! Well all those savings go out the window if you are paying interest on the credit card that you bought them with! Start paying them down, then stay in the habit of paying your credit card bill. In full. Every. Single. Month. AUTOPAY PEOPLE.

Get ready for next week’s article. It’s a good one. Hint: housing.

extra bits for my paid subscribers:

- Save BIG money on clothes!

Keep reading with a 7-day free trial

Subscribe to The hardest part of vet school is... GETTING IN. to keep reading this post and get 7 days of free access to the full post archives.